Part II - The Loophole

In Part I of this three part blog (found here), I wrote about California's prohibition on surcharges for the use of credit cards. Part II is about the loophole in the law and why its bad for consumers.

The actual language of the law can be found in California Civil Code section 1748.1(a). The first sentence stopped retailers from charging extra for customers who want to use their credit card. The second sentence states:

A retailer may, however, offer discounts for the purpose of inducing payment by cash, check, or other means not involving the use of a credit card...

This means a retailer can give a discount for paying cash, but cannot charge extra for using a credit card. But isn't that the same thing?

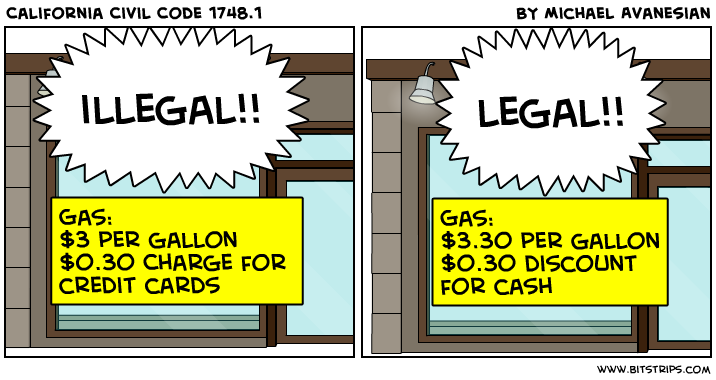

The comic below hopefully demonstrates the absurdity of the law:

So why was this law passed? The legislators included a statement of their intent:

(e) It is the intent of the Legislature to promote the effective operation of the free market and protect consumers from deceptive price increases for goods and services by prohibiting credit card surcharges and encouraging the availability of discounts by those retailers who wish to offer a lower price for goods and services purchased by some form of payment other than credit card.

It's really simple, the legislators don't want consumers to be lured into a store offering merchandise at once price, only to be tricked by the retailer as they pull out their credit cards.

How is this supposed to work in real life? Taking it to the extreme, suppose it costs a retailer $0.50 per transaction to use a credit card. A 25¢ piece of gum is supposed to be advertised at 75¢ but when the customer comes in to buy the gum, he will be offered 50¢ off for using cash.

It does not make sense to operate like this, and if the end monetary result is the same (i.e., a price difference between paying cash and using a credit card), why pass this law?

It turns out there is a litany of studies that show consumers perceive credit-card surcharges negatively as a kind of loss or penalty, while cash discounts are perceived positively as a kind of gain or bonus. You, the consumer, feel bad when you have to pay extra fees for using a credit card, and feel great when given a cash discount.

Credit card companies realized that if consumers feel bad when they use their credit cards, they will use them less often. The net result would be more people would use cash, which would consequently impose a downward pressure on the fees credit card companies can charge retailers.

Other consequences of this law will be discussed in Part III of

this article which focuses on the constitutionality of the law.

No Comments

Leave a comment